Medicare Supplement (Medigap)

Parts A and B of Original Medicare do not provide comprehensive coverage. It doesn’t set a cap on how much you can spend out-of-pocket annually for healthcare bills, and it only covers a percentage of your costs for covered services.

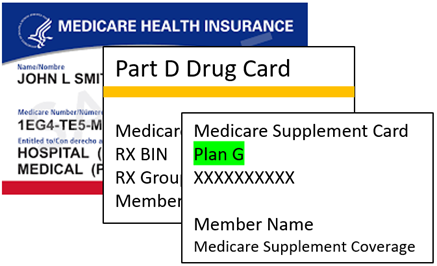

Many commercial insurance providers provide Medicare Supplement, or “Medigap” insurance policies that help cover your medical expenses, to help close these coverage gaps. In the event that you have a Medigap coverage, Medicare will still contribute to the approved sum for the eligible treatments. Then, your Medigap insurance pays its proportion.

In contrast to Medicare, which has the largest network in the country, Medigap policies have significantly larger networks and require a monthly premium payment to the insurance provider.

Medicare Part C (Medicare Advantage)

Private insurance providers having a contract with the federal government provide Medicare Part C, also referred to as Medicare Advantage. Your Part A hospital, Part B medical, and frequently Part D prescription drug coverage are all combined into one plan under Medicare Advantage. Offer all of Original Medicare’s (Parts A and B) benefits.

contain added benefits that Original Medicare does not often cover, including as vision, hearing, dental, and wellness. You should keep your annual out-of-pocket medical spending to a minimum. It might charge you more when you use out-of-network providers and mandate that you only utilize providers in the plan’s network. Any plan modifications must be communicated to you before the following enrolment period. Are only available to you if you’re enrolled in both Medicare Part A and Medicare Part B.